Should gunmakers, ammunition manufacturers, and law-abiding Americans who buy these products pay higher taxes to fund government-sponsored gun control and mitigate the damage done by criminals? With midterm elections just weeks away, some Democrats are championing that very idea: a new tax hike on firearms and ammunition. If a newly resurrected bill passes, it will mean the first such tax hike in about a century.

“Raising the tax on firearms would provide an offset to the massive cost to society of gun violence — exactly as taxes on alcohol and tobacco have successfully done.”

— Rep. Bill Pascrell, Jr.

The Gun Violence Prevention and Safe Communities Act was recently reintroduced in the House by US Reps. Bill Pascrell, Jr. (D-NJ) and Danny K. Davis (D-IL). It seeks to raise the federal Firearms and Ammunition Excise Tax (FAET) on guns and ammunition to create a guaranteed stream of funding — as much as $38 million annually — for gun violence prevention. It would also index some of these taxes to the rate of inflation.

In a recent Tweet, Mark Oliva, managing director of public affairs at the National Shooting Sports Foundation (NSSF), wrote of the bill in question: “If they can’t ban your guns, they want to tax the industry to fund their antigun biases.”

GOOD RANGE GEAR – Take a Piece of American Grit Wherever You Go With the BRCC Death Pot PVC Patch

Will This New Gun and Ammo Tax Bill Pass?

In the end, he said, companies will simply pass the increased costs on to the customer.

But does the legislation have legs? Probably not. Oliva told Free Range American he thinks it’s nothing but election-season posturing. “This bill won’t go anywhere,” he said. “It won’t even get a committee hearing, much less a vote by the House. It would be dead on arrival in the Senate.”

Pascrell and 21 of his colleagues in the House of Representatives clearly feel higher gun taxes is an idea that will resonate with voters in November enough to resurrect this legislation that was first introduced in 2018.

“Gun violence continues to threaten communities from coast to coast, and Congress has a responsibility to stem the crisis,” Pascrell said. “After decades of inaction, raising the tax on firearms would provide an offset to the massive cost to society of gun violence — exactly as taxes on alcohol and tobacco have successfully done. [….] This bill would be a down payment on safeguarding our children, our communities, and our future. It is the type of solution the American people demand.”

RELATED – FBI Pressures Citizens to Forfeit 2A Rights via Nics E-Check Form

What Exactly Is in the Tax Hike Bill

According to a draft summary of the bill, uploaded to Pascrell’s congressional website, if passed, it would:

• Apply the FAET to “assault-weapon” frames and receivers. “If these frames/receivers are firearms under the Gun Control Act,” the bill reads, “they should be firearms under the tax code.”

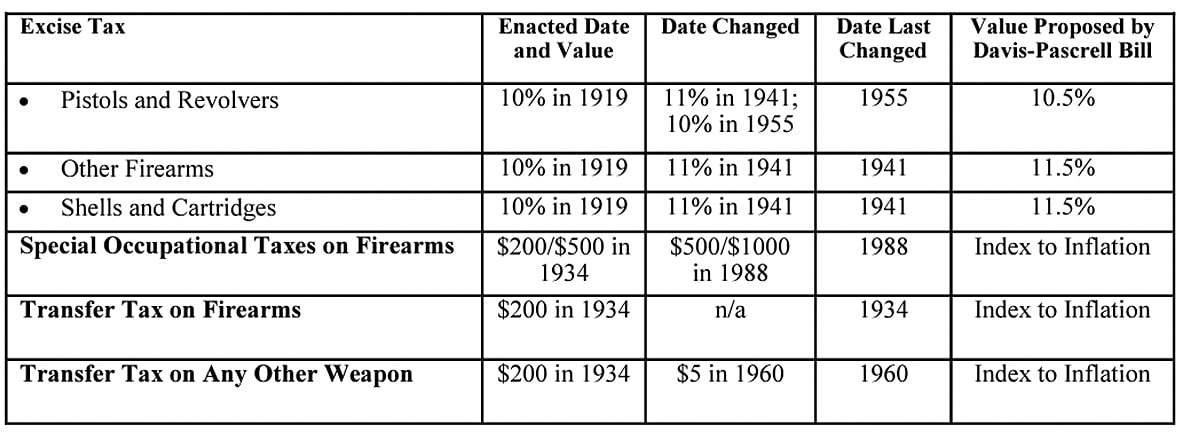

• Increase the FAET on guns and ammunition by 0.5% to create guaranteed annual funding for gun violence prevention. Under current law, the federal excise tax on pistols and revolvers is 10%, which would be increased to 10.5% under the Democratic bill. The excise tax on other firearms and shells/cartridges is 11%, which would increase to 11.5%. The stated goal of the tax hike is to “yield stable revenue of approximately $20 to $38 million each year into a ‘trust fund.’”

• Index the occupational and transfer taxes related to firearms to inflation. Under the National Firearms Act, importers, manufacturers, and dealers of firearms pay a special occupational tax, and weapons owners pay transfer taxes. The bill claims these taxes are overdue for an increase because they haven’t been raised in several decades.

GOOD RANGE GEAR – Keep Your Coffee Hot With the BRCC YETI Reticle Rambler Mug

For the most part, existing federal excise taxes for guns and ammunition were originally enacted to support conservation efforts. The Pittman-Robertson Act of 1937 apportioned these tax dollars to state wildlife agencies, hunter education programs, and the operation of archery and shooting ranges.

Nothing in the proposed legislation appears to impact conservation dollars one way or the other. Rather, its purpose seems exclusively focused on raising money to fund a new “Gun Violence Prevention Trust Fund,” consisting of four primary programs:

- Community-Based Violence Intervention & Prevention, supporting “comprehensive, education programs with adults and youth.”

- Gun Violence Research at the Center for Disease Control, National Center for Injury Prevention and Control, and the National Institutes of Health.

- Hate Crimes Data Collection, Prevention, and Enforcement to fund grants, training, and other forms of assistance for “preventing, addressing, or otherwise responding to hate crimes.”

- Forensic Examiner Training to Improve Gun Crime Clearance Rates to fund ATF activities at the National Firearms Examiner Academy to “train and certify forensic examiners.”

With the recent news that credit card companies plan to implement a new transaction code for tracking gun-related purchases, many in the 2A community see this bill as another lightly veiled swipe at the gun industry and law-abiding gun owners — a punitive “sin tax” to fund federal gun control efforts, well into the future.

READ NEXT – Corporate Gun Database? Major Credit Cards Add Code for Firearm Purchases

Comments